AWS Still King, Azure Grows Fastest, IBM Falls

By Jeffrey Burt, Channel Partners

Amazon Web Services continues to dominate a global cloud-infrastructure services industry that hit almost $70 billion last year, grabbing a market share equivalent to that of the next four public cloud providers combined.

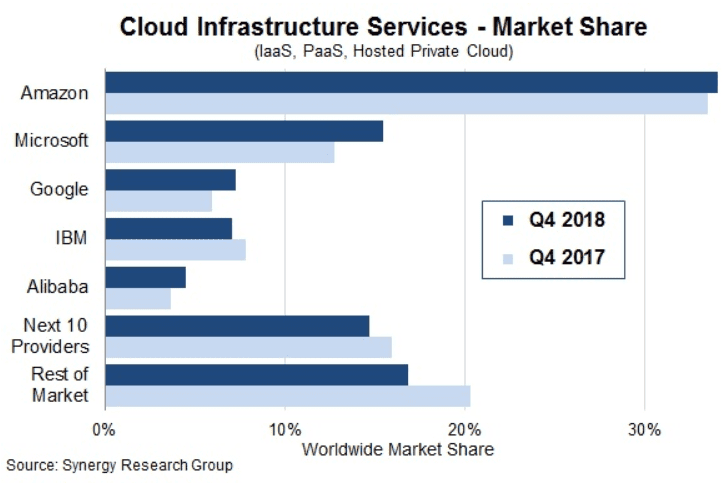

New numbers from Synergy Research Group show AWS’ share of market revenue climbed to about 35 percent in the fourth quarter of 2018, with Microsoft’s Azure business growing the fastest among the top players and pushing to more than 15 percent. In the top five, two other providers, Google and Alibaba, also saw revenue gains, though IBM – fourth on the list – saw a slight decline.

Synergy Research analysts said IBM has a different focus than its competitors and that it’s the leader in hosted private cloud services.

John Dinsdale, chief analyst at Synergy, says the 48 percent growth rate in the market – which includes infrastructure as a service (IaaS), platform as a service (PaaS) and hosted private clouds – over the course of 2018 is unusual for an industry of such scale. IaaS and PaaS made up the bulk of the market, and those revenues jumped 49 percent in the fourth quarter over the same period in 2017.e 48 percent growth rate in the market – which includes infrastructure as a service (IaaS), platform as a service (PaaS) and hosted private clouds – over the course of 2018 is unusual for an industry of such scale. IaaS and PaaS made up the bulk of the market, and those revenues jumped 49 percent in the fourth quarter over the same period in 2017.

“The rate at which the market leaders continue to expand is really rather impressive,” Dinsdale said. “In aggregate, the top five drove up their revenues in these segments by 60 percent in 2018, which has caused us to review and increase our five-year forecast for the market. Inevitably, there will be a few road bumps along the way, but these will be minor relative to the factors that continue to drive the market.”

The growth rates throughout last year were higher than in 2017, and the success of the top five players came at the expense of small and midsize cloud providers, which collectively saw their market share drop 5 percent during 2018. Those smaller companies are still making money and growing revenue, but not at the same rate as AWS and the other top providers, the analysts said.

The growth in business isn’t surprising, given the news from the top providers’ earning reports over the past several weeks. AWS said that in the last three months of 2018, the company saw revenue grow 45 percent year over year, hitting $7.4 billion. Microsoft executives said revenue for Azure increased 76 percent, with Canalys analysts estimating the public cloud business garnered $4 billion in the fourth quarter. IBM said that for most of 2018, cloud revenue for the company increased about 20 percent.

Alphabet, Google’s parent company, did not reveal its cloud revenue when announcing fourth-quarter numbers this week, but Google CEO Sundar Pichai during a conference call said Google Cloud is a “fast-growing, multibillion-dollar business that supports major Global 5000 companies in every important vertical with a robust enterprise organization.”

Pichai also noted that the search giant in 2018 more than doubled its number of Google Cloud Platform deals worth more than $1 million and surpassed 5 million paying customers for …

...See the full article at Channel Partners

For clear and concise information about the best Hyperscaler/Public Cloud solution for you, or private, hybrid, colo, and BCDR contact the experts at Cloud 9 Advisers. We'll save you time and money and give you peace and clarity. We'll provide you with confidence in the purchase of your solution